This is How An Algorithmic Crypto Strategy Made +3,332% With RealTest

Backtesting a Crypto Futures Mean-Reversion Trading Strategy With RealTest. (+Code)

Introduction:

SetupAlpha develops algorithmic trading strategies based on academic and proprietary research. We provide fully coded RealTest strategies, tested, transparent, and ready for real-world results (with code that Python etc users can adapt). Explore our full library here: https://setupalpha.com/

Let’s start

Most of us love the idea of riding crypto’s big waves.

The headache is the in-between: markets don’t trend most of the time, and when regimes turn choppy.

We felt that pinch ourselves so we asked a simple question: “could a light mean-reversion entry, wrapped inside a trend filter and cost-aware execution, deliver trend-like upside with far less pain?”

Context & Research

We didn’t start from zero. Three threads shaped this test:

Trend exists across assets. Moskowitz, Ooi & Pedersen (2012) documented time-series momentum across equities, currencies, commodities, and bonds. The idea: when an asset’s own past return is positive, it tends to keep going for 1–12 months. We don’t need to be dogmatic trend-followers to respect this drift.

Short-term exhaustion is real. For entries, Larry Connors & Cesar Alvarez popularized RSI(2) pullbacks, tiny windows where stretched price action snaps back. That playbook has been replicated and debated for years, but the gist holds: short-term weakness inside a longer-term uptrend is often buyable.

Volatility and costs matter in crypto. As the market has matured, realized volatility has cooled from its early wild days, still lively, but not the same beast, and microstructure costs (maker/taker fees, funding) make execution choices non-trivial.

https://www.fidelitydigitalassets.com/research-and-insights/closer-look-bitcoins-volatility

On funding and fees: perpetual futures levy periodic funding between longs and shorts; maker orders generally pay less than taker orders. If you trade frequently, those basis points compound. https://www.binance.com/en/support/faq/detail/360033525031

Simple Setup Idea

We wanted to answer a simple question: Can a basic mean-reversion overlay improve risk-adjusted returns in crypto futures?

Here’s the structure we tested in RealTest:

Universe: 500+ USDT-margined Binance futures contracts

Entry Rule: Price above 50-day moving average and short-term RSI(2) oversold (<30).

Entry Filter: Must touch the lower Bollinger Band, forcing entries only when panic selling hits.

Exit Rule: RSI(2) overbought (>80).

Position Cap: Maximum 10 concurrent positions, equally weighted.

Execution Costs: Maker/taker fees included, with zero price-rounding to avoid fractional token errors.

We used daily bars, no leverage, and assumed full portfolio exposure capped at 100%.

It looks like it works, but not the way we’d like.

Our Next Version (what we actually use & you can download)

Next, we did deeper research and applied a more robust filter and the results were amazing!

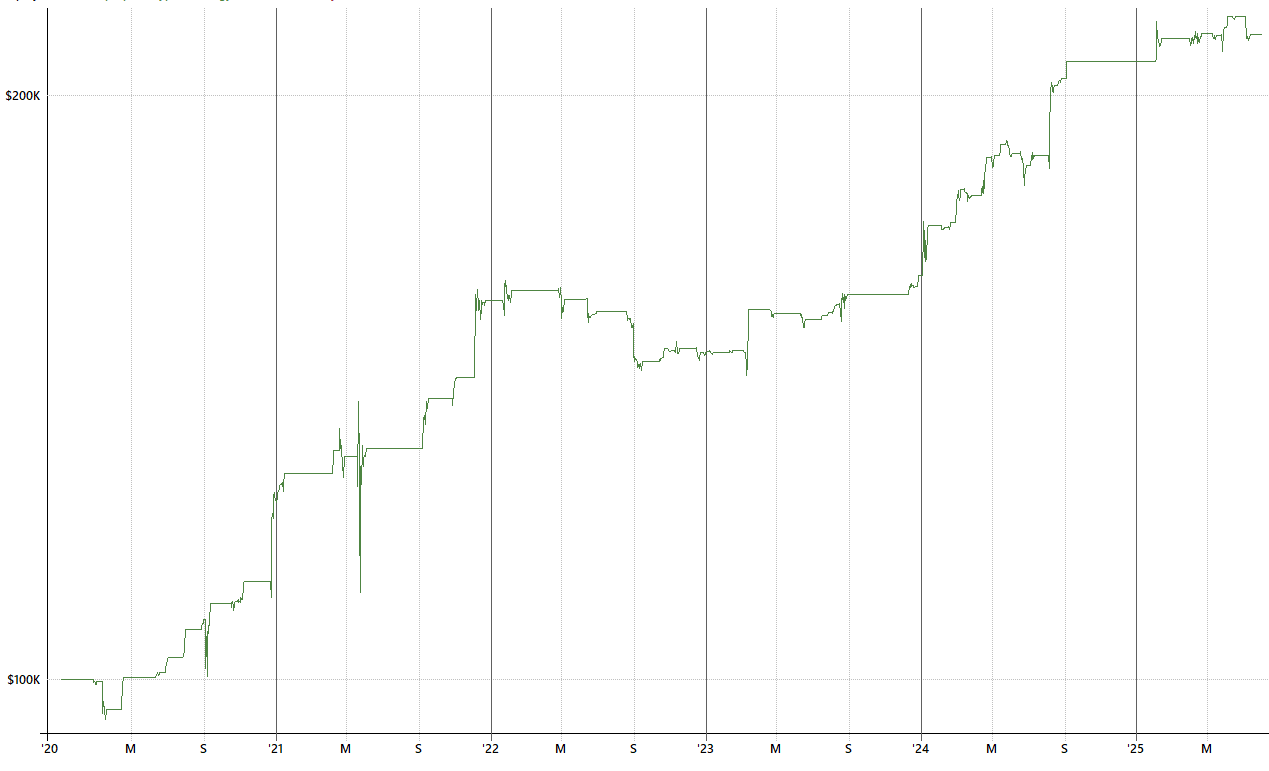

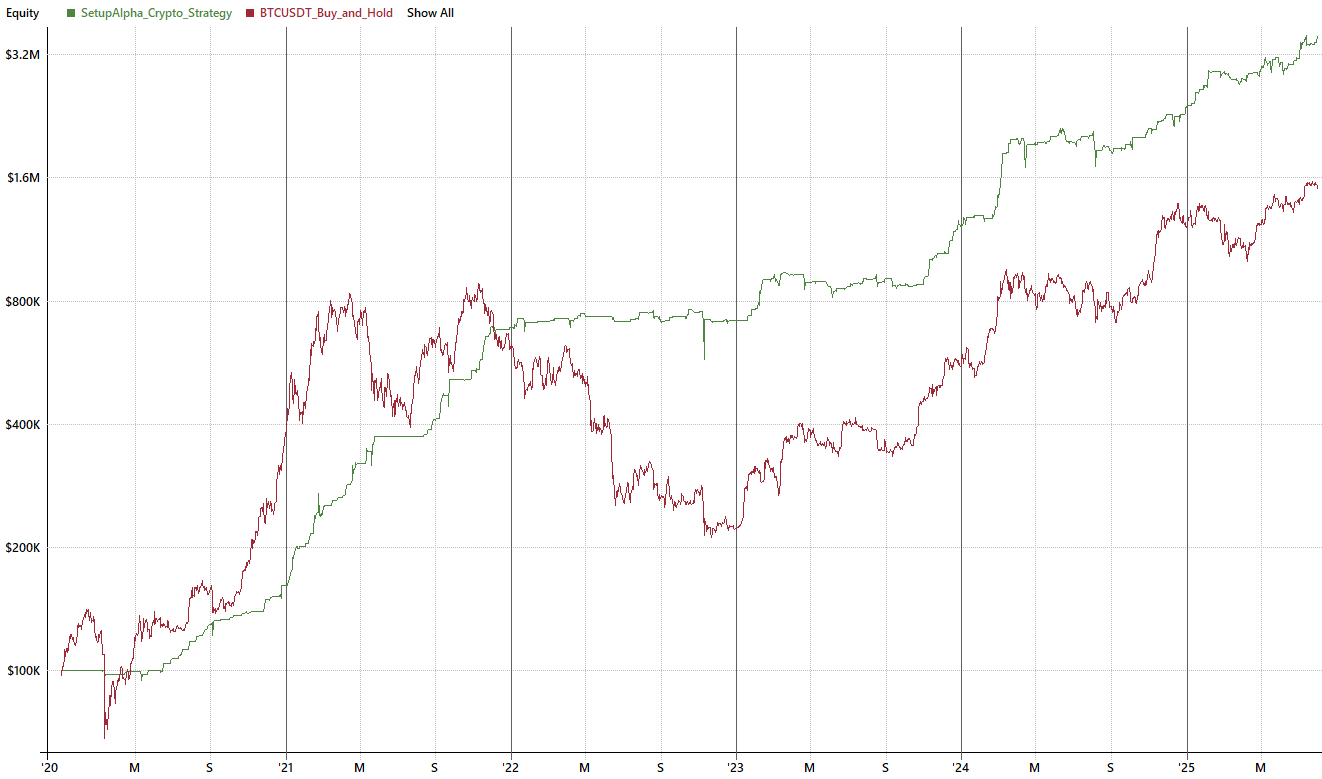

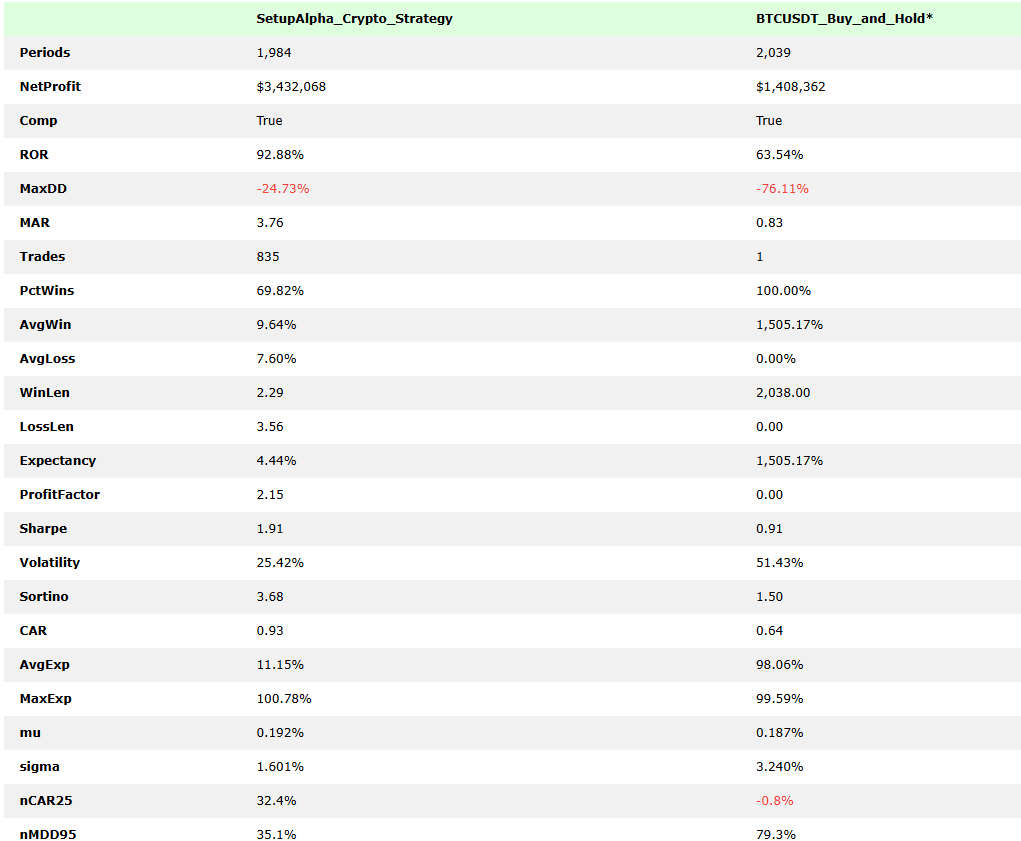

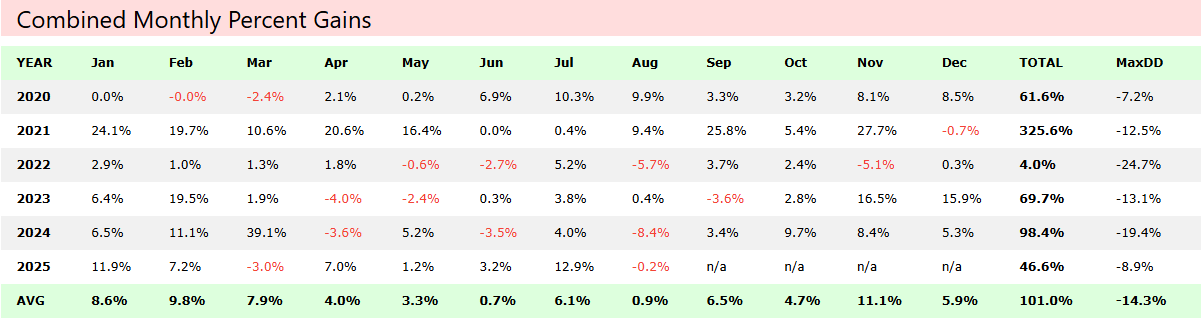

Sharpe Ratio is almost 2.

This is beating just holding Bitcoin.

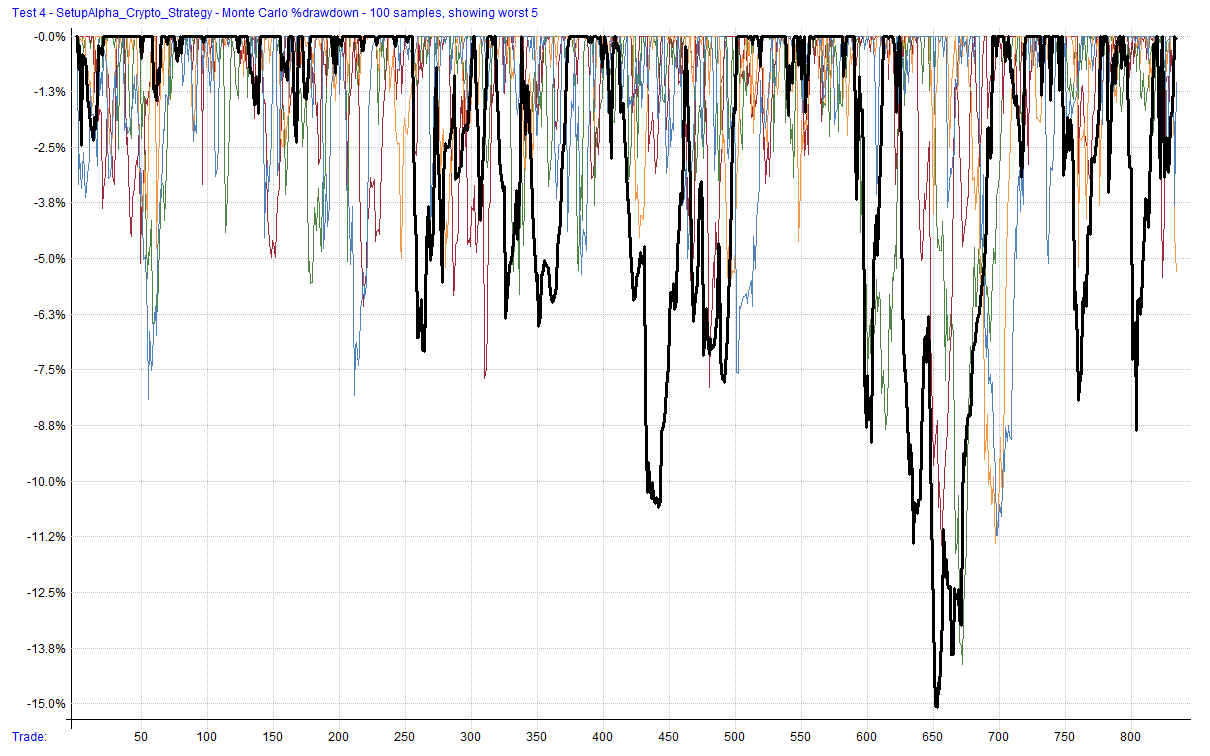

The MAR (+3,7) bump might look “incremental,” but if you’re running a portfolio of 5–8 uncorrelated systems, that improvement can be the difference between a –25% and –15% multi-strategy drawdown.

Fewer large losers also reduces the psychological cost of sticking to the plan.

Download this crypto strategy HERE

Even if you use Python, Amibroker, or any other platform, you can easily convert the rules.

Plus, you’ll get a free CSV with 500+ Binance Futures symbols.

Connecting to the Bigger Picture

The lesson here is bigger than crypto. In equities, futures, or FX, traders face the same trap, relying on pure trend-following leaves them exposed to long sideways regimes. A simple overlay, whether mean reversion, volatility targeting, or breadth filtering, can dramatically improve robustness.

Academic papers, quant blogs, and forum debates all circle the same conclusion: edge today isn’t about chasing complexity. It’s about combining simple, transparent filters into resilient portfolios.

Closing

In our tests, layering a reversion filter onto a basic crypto trend-following idea cut drawdowns by two-thirds and doubled risk-adjusted returns. More importantly, it turned a fragile strategy into something we could actually trade live.

That’s the real takeaway: in 2025’s calmer crypto market, trend-following alone isn’t enough. But with the right overlay, you can still build systems that compound reliably, without curve-fitting or false promises.

So download this advanced crypto mr strategy HERE.

And this is “simple crypto“ mr code here.

Notes:

This is not financial advice.

Educational purposes only.

Import:

DataSource: CSV

CSVFields: Date,Symbol,Open,High,Low,Close,Volume

DataPath: D:\CRYPTO TRADING\binance_futures_data

StartDate: 1/1/2000

EndDate: Latest

SaveAs: Crypto.rtd

Settings:

DataFile: Crypto.rtd

StartDate: Earliest

EndDate: Latest

BarSize: Daily

AccountSize: 100000

Parameters:

positions: 10 // Maximum Positions

Data:

Buy: c>avg(c,50) and rsi(2)<30Subscribers can download the other half of the code here + crypto data.👇