The "Late Entry" Edge: How Missing the Breakout Actually Boosts Your CAGR

Why catching confirmed winners beats chasing perfect prices.

“Trend following is dead.”

We hear this refrain every year. And reliably, simple momentum systems manage to capture the outliers that drive 80% of long-term portfolio returns.

But for the systematic trader, the challenge is rarely identifying the trend. The challenge is the Execution. Specifically: what does your system do when it receives a valid signal but your portfolio is full?

This week I want to talk about one of the most critical and misunderstood aspects of portfolio management: Path Dependency.

The Scenario: Missing the Train

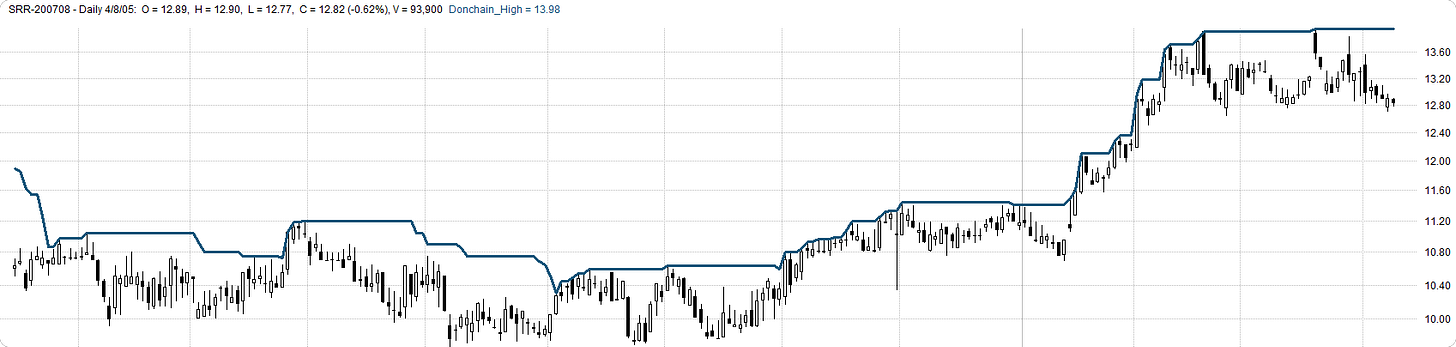

Imagine a classic trend-following strategy say, a 20-day breakout or a moving average crossover.

Month 1: Asset A hits a buy signal.

The Constraint: Your portfolio is already 100% invested. Your system forces a “Pass.”

Month 2: Asset A is now up another 10%. You finally sell an old position and have cash available.

The Dilemma: Do you buy this “late” trend? Or has the train left the station?

The “Loss of Momentum” Fallacy

Intuitively, most discretionary traders shy away from the second entry.

“I missed the good price.”

“The risk-reward is ruined.”

This is Anchoring Bias anchoring your value perception to the price you could have had rather than the price the market offers today.

A Real-World Example: ETF Rotation

The best way to understand this is to look at strategies that force you to ignore entry price and focus entirely on Relative Strength State.

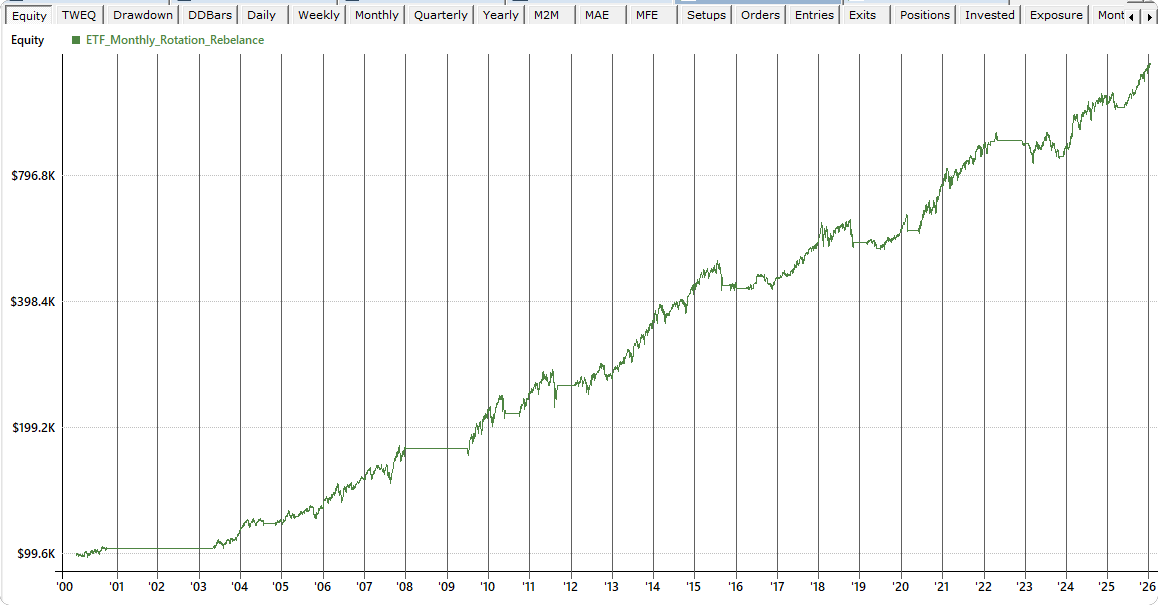

Take our ETF Rotation Monthly Rebalance Strategy.

This system doesn’t care if it “missed” the bottom of the Nasdaq in January. It simply asks one question on the first of every month: “What is the strongest asset class right now?”

If Equities (QLD) are leading, it holds Equities.

If Bonds (TLT) are performing, it shifts to Bonds.

If Crypto (IBIT) are outliers, it rotates there.

By design, this strategy is almost always “late” to the initial turn. It waits for the trend to prove itself on a monthly timeframe. And yet, because it systematically rotates into what is working (and cuts what is dying), it avoids the catastrophic drawdowns of buy-and-hold while capturing the bulk of major bull runs.

The lesson here is simple: The State of the trend (is it leading?) matters infinitely more than the Event of the breakout (did I catch the first green candle?).

But is there a mathematical penalty for entering late?

Here is the data-driven breakdown of why "perfect" entries are a mathematical anchor on your portfolio and the three specific "Late Entry" signals that actually outperform the breakout.