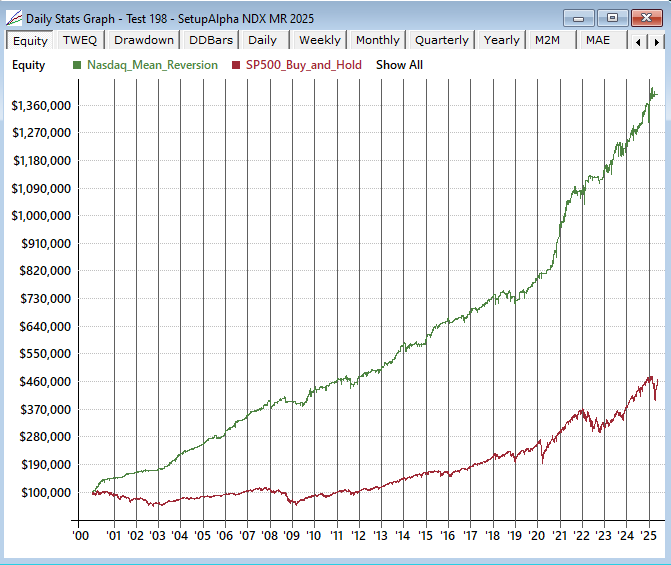

Low Drawdown Nasdaq Mean Reversion Strategy | RealTest

Volatility Forecast + Mean-Reversion = Edge (not another RSI strategy)

Introduction:

SetupAlpha builds ready-to-use trading strategies with RealTest, based on real data, academic research, and deep testing. Our team of experts handle the research, coding, and validation so you don’t waste hours reinventing the wheel.

Many entrepreneurs use our strategies to save time and focus on their own projects, while still running robust trading systems in the background.

Download our RealTest strategies and start instantly - https://setupalpha.com/

When most traders hear "mean reversion," their minds typically go to RSI. This is not another RSI based mean-reversion strategy.

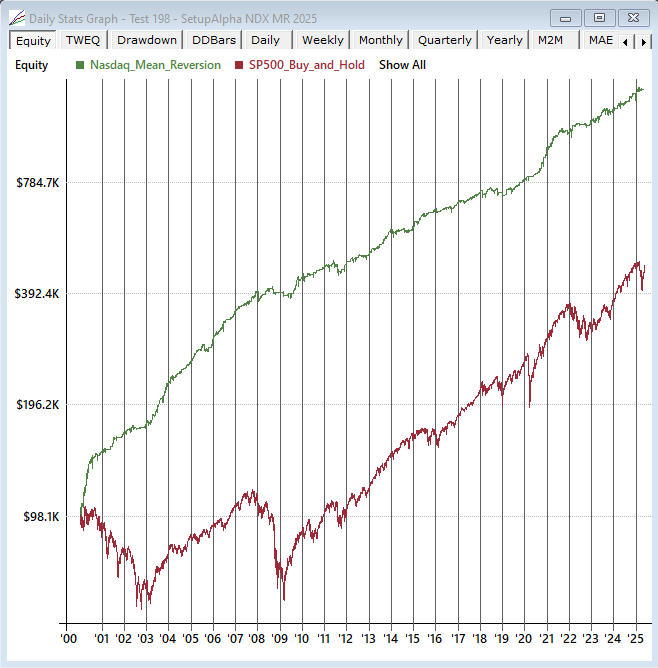

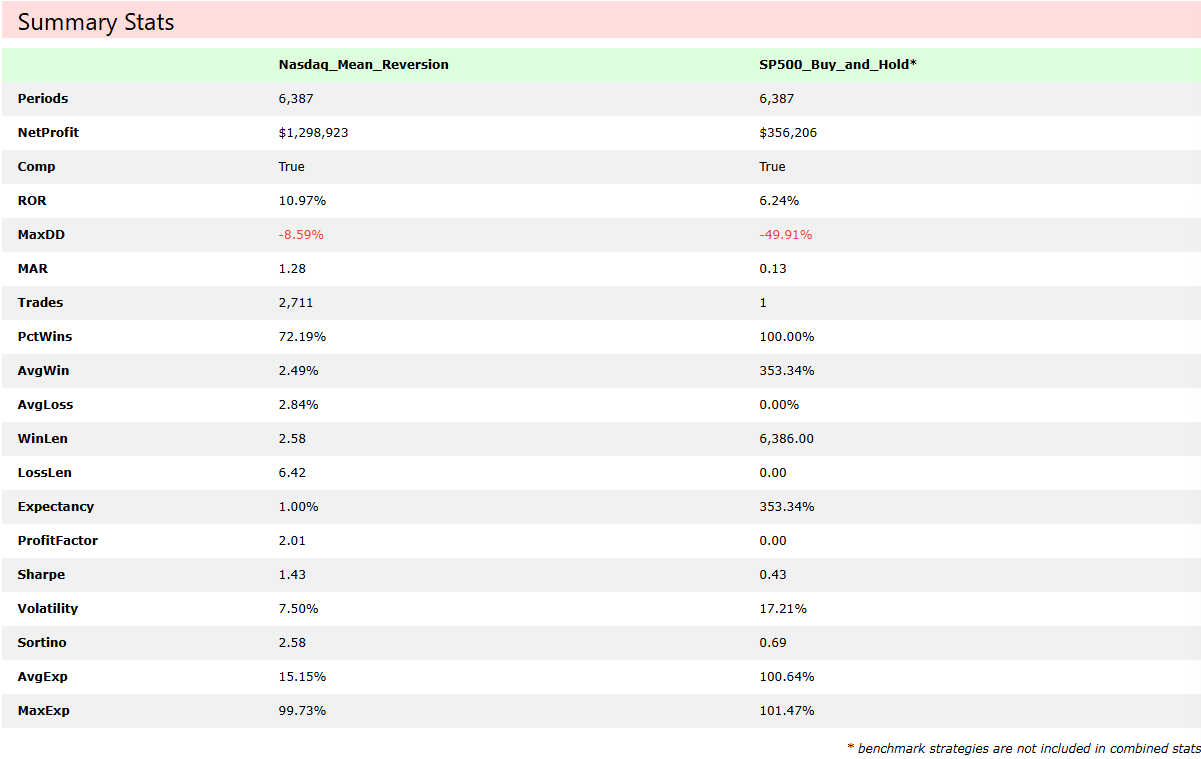

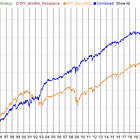

In this post, we're breaking down a higher frequency Nasdaq-focused mean reversion strategy that’s different from the usual S&P or Russell setups. We’ll cover how it works, why Nasdaq stocks require a different approach, what indicators we're using, and how it performs even after commissions and limit extras. We’ll also touch on why this strategy is actually usable in the real world and how you can get access to it.

Why Nasdaq?

Traditionally, most mean reversion systems are focused on S&P 500 or Russell stocks. Why? Because those universes tend to have more erratic movements and bigger short-term drops great for mean reversion. Nasdaq 100 stocks, by contrast, are often more stable, less volatile, and dominated by big institutional holdings. That means the usual deep-pullback triggers don’t really work here.

But stability isn’t a bad thing.

Stable stocks mean fewer false signals. They’re usually safer to buy into on a dip because they’re held by large funds. And with less volatility, there’s also less risk of catching a falling knife.

So, we built a system specifically for Nasdaq behavior, tight pullbacks, lower volatility, and fast exits.

Got 30 seconds?

Answer 3 quick questions to shape what we build next at SetupAlpha.

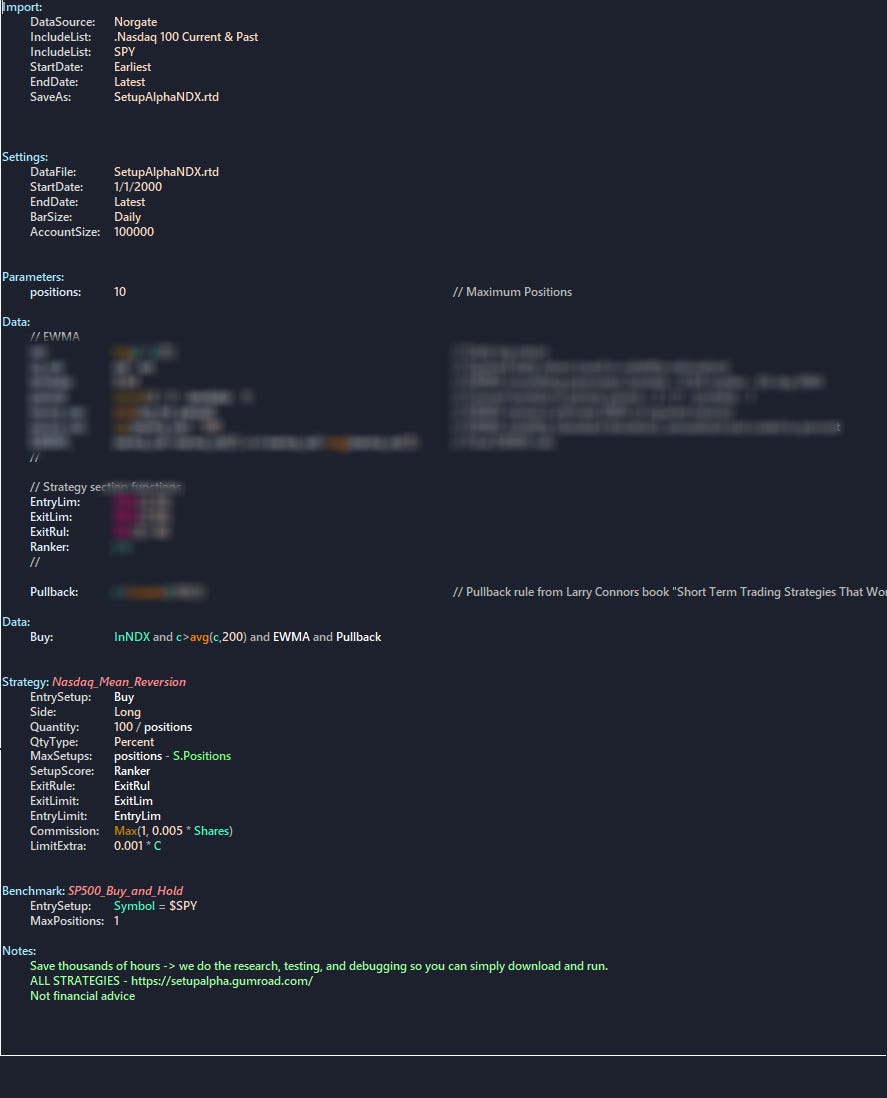

Strategy Logic – How It Works

We kept it minimal and robust. Here's the breakdown:

Universe: Only Nasdaq stocks

Pullback: We added one of the proven conditions from the Connors & Alvarez book Short Term Trading Strategies That Work

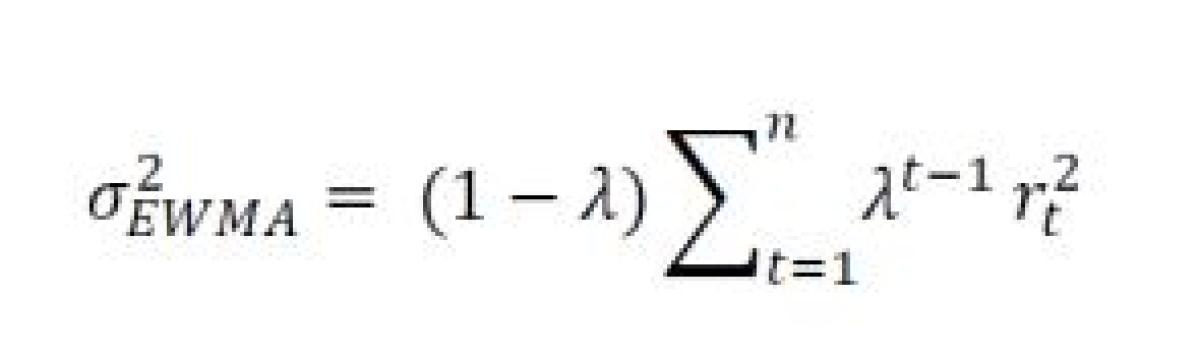

Volatility Forecast filter: Uses an EWMA-based (Exponentially Weighted Moving Average) volatility forecast, a method borrowed from quant machine learning hedge funds.

Check out the research paper on volatility forecasting we used here.

Trend Filter: close > avg(close,200)

Execution: Limit entry + limit exit.

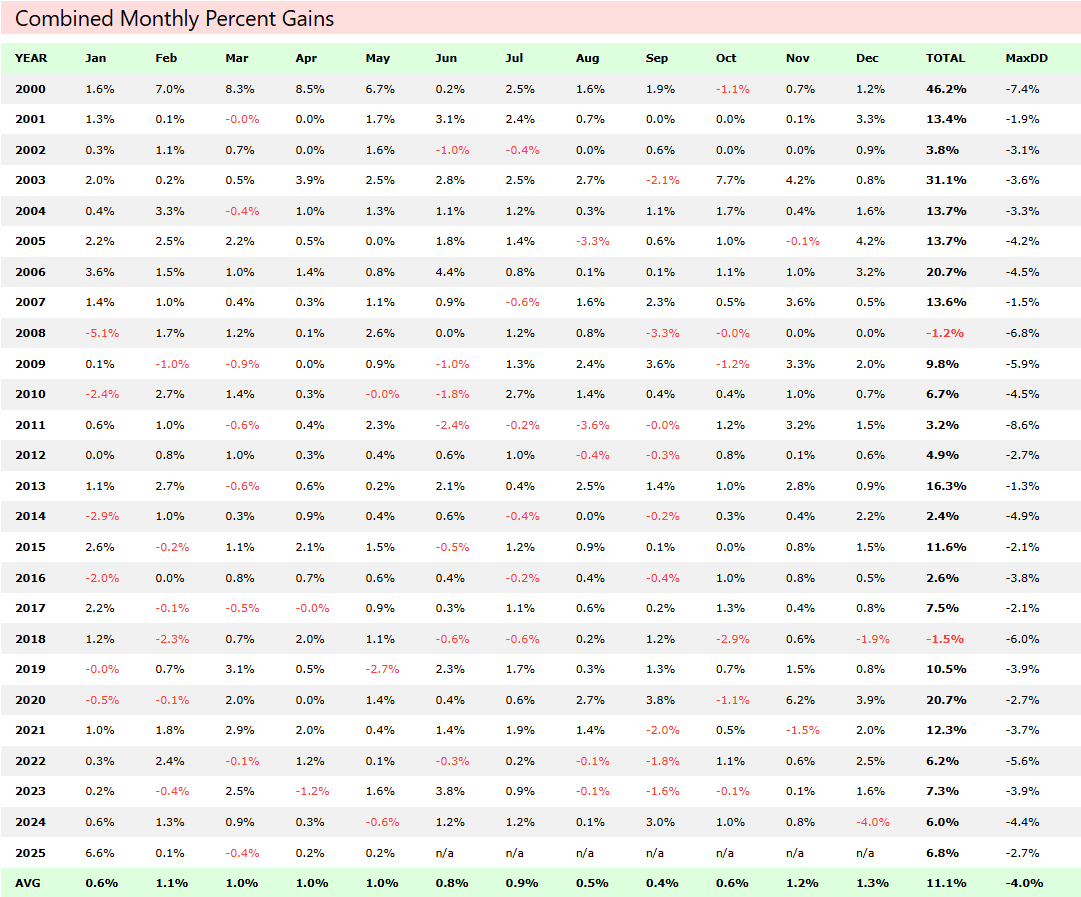

Real-World Execution Layer: Includes Interactive Brokers commissions and a buffer to account for order slippage and missed fills.

Want to get full RealTest code? Download rules & code here.

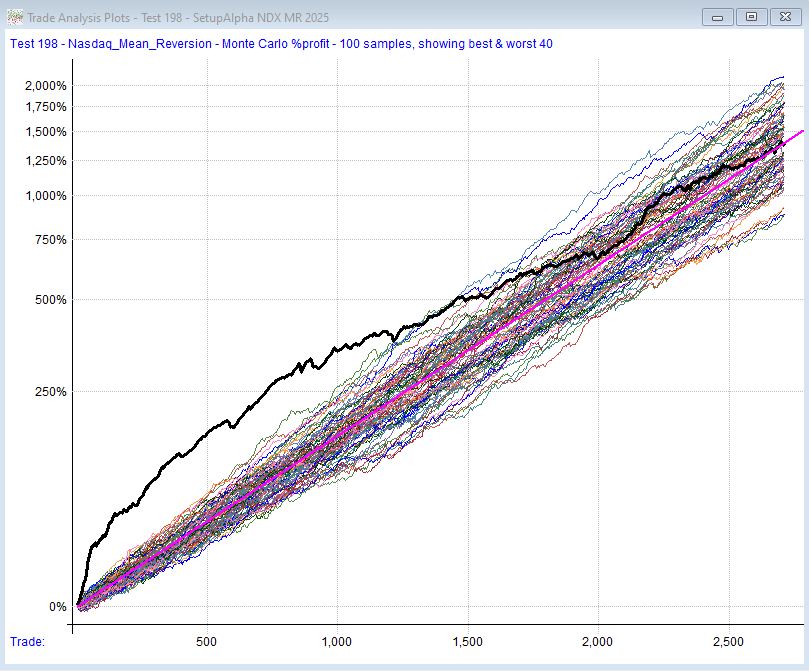

Robustness & Realism

This strategy includes:

IB Commissions: A realistic cost layer that retail traders actually face.

Limit Fill Buffer: Because you never get perfect fills, especially on pullbacks.

Delisted Stocks: Ensures we’re not cherry-picking winners. Survivorship bias is a strategy killer.

Max Positions Testing: We tested with 5 and 10 simultaneous positions. Both held up, with slightly more volatility (and higher returns) when fewer positions were used.

You can access the complete RealTest code via the link HERE.

Python users can download it and RealTest code to Python with chatgpt. If you need help, reach out.

Bonus: New SetupAlpha Strategy Discussion Group

We’re launching a private group for all strategy buyers.

It’s a place where we:

Tech support if you want to combine your strategies/portfolios.

Share updates and variants on existing strategies

Exchange performance reports and robustness tests

Dive deeper into RealTest scripting logic, optimization tactics, and portfolio construction

Next week, we’ll send out a short survey to existing buyers to decide where we’ll host this (Discord, etc.).

If you’ve purchased a strategy, you’ll be invited. If not, you can still join any time in the future once you do. No subscriptions, no monthly fees.

Just traders, learning together (and 100x faster).

Questions? Want to Learn More?

If anything was unclear or you want to dig deeper into how we test things, feel free to reach out.

And if you haven’t already:

Subscribe on Substack