How to Go Live Without Getting Smacked by a Drawdown - Part 2

Welcome back, friends.

Last week in Part 1, we talked about “why drawdowns actually happen and why they’re not random”.

Market regime shifts, volatility spikes, and design flaws can trigger your system to fail.

But today is more personal.

This one’s for the traders who says:

“I finally built something that works… but what if I go live and it immediately loses?”

That’s not paranoia. It’s experience talking. And today, I want to show you how to protect yourself before the pain hits.

Let’s fix the two main things that trip people up:

Timing and Sizing.

1. Timing: You Can’t Avoid Luck - But You Can Manage It

Here’s the truth:

The day you go live matters.

But you can’t control it.

Some examples from SetupAlpha users:

Someone went live in May 2025 - caught a smooth trend and had an amazing first month.

Another went live in March 2025 - walked straight into market chop and ate three losses in a row.

Same strategy. Same code. Totally different results.

Why?

Because live trading introduces timing luck and most traders overreact to it.

They think:

“Maybe the system’s broken.”

“Maybe it’s overfit.”

“Maybe I’m cursed.”

Relax.

The Fix: Start When You’re Ready - Not When the Market’s Perfect

You’ll never know the best time to go live.

But what you can do is prepare yourself mentally and structurally so the early losses don’t shake you out.

Here’s the mindset shift:

Treat your first 3 months like an onboarding period not a verdict.

Expect randomness, not performance.

Focus on execution and consistency.

Even if your equity curve dips at the start, you’re still doing it right.

2. Sizing: Make It Boring on Purpose

It’s not usually the strategy that fails it’s that the trader sizes too big too early and panics during a drawdown.

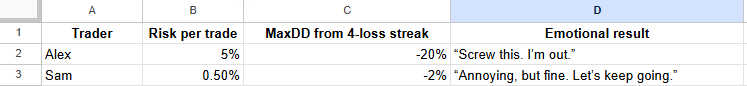

Let’s look at two traders with $10,000 accounts:

Same system. Different outcomes. The only difference? Sizing.

The Fix: Size Tiny Then Fund Gradually

Start small. Like, boring small.

And here’s a psychological trick:

Add a small deposit each month.

Let’s say you add $200 monthly from your salary. Even if you lose $200 that month, your equity curve stays flat. It feels like you’re not losing. You’ll keep going.

It’s not just about risk.

It’s about building trust with your own system.

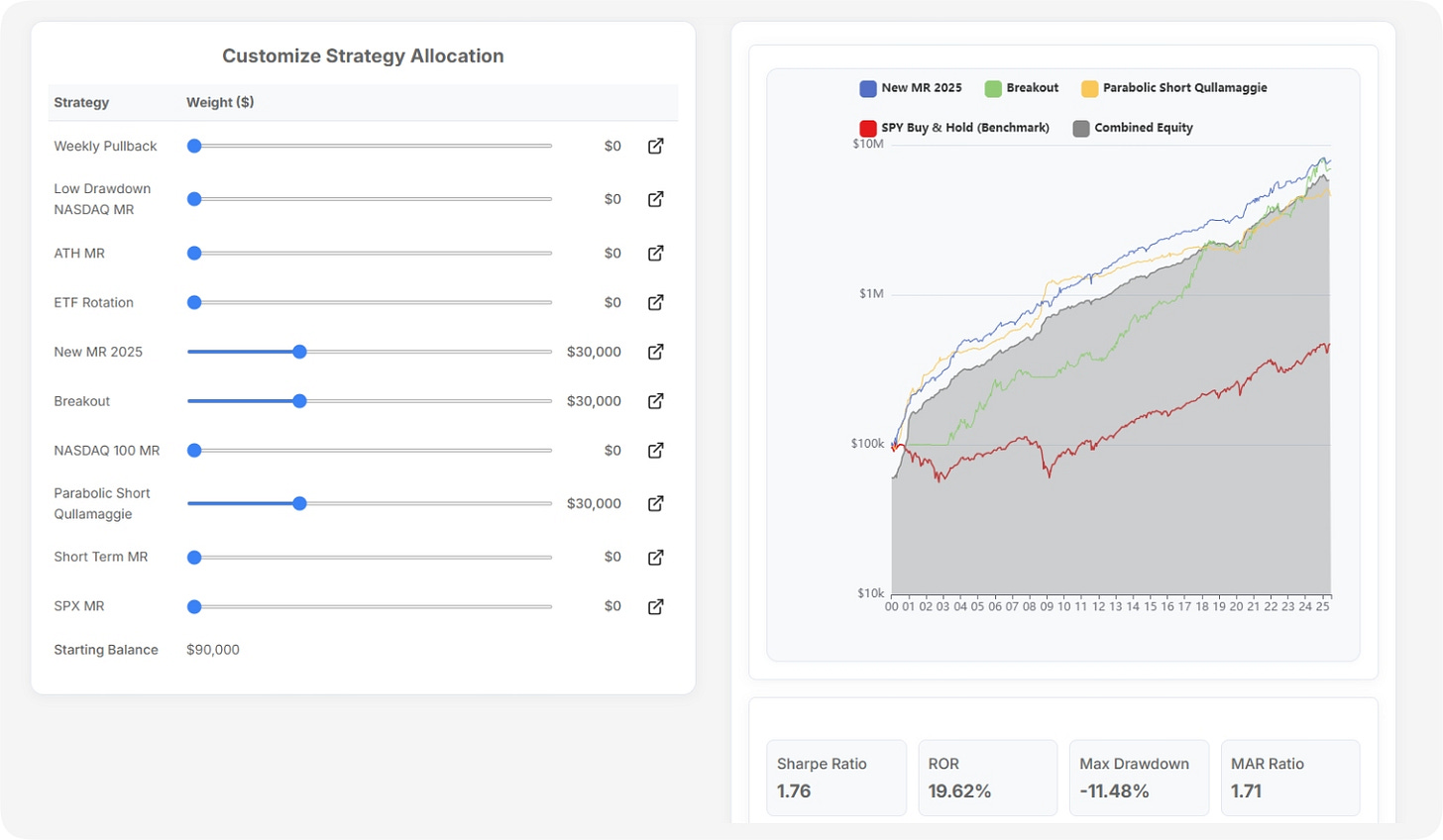

And if you haven’t tried our brand-new Portfolio Builder yet, make sure to test it out now, build your dream RealTest portfolio in seconds.

Check out our RealTest trading strategies - https://setupalpha.com/collections/realtest-strategies-and-backtests

RealTest Tip: Simulate a Bad-Luck Launch

If you want to see what a bad start would look like before you go live, just shift your backtest start date by a few weeks and rerun it.

Example:

StartDate: 2023-08-23 // instead of 2023-11-01You’ll likely find that the system still wins eventually, but with a rougher start.

This builds confidence because now you know what "bad luck" looks like, and you’ve already seen the recovery.

Subscribe to catch Part 3: How to Build Systems You Can Actually Hold

Next week, we’ll cover how to:

Build systems that feel good to hold

Optimize for emotional consistency

Match system profiles to your own psychology

Know when to quit… and when to stick it out